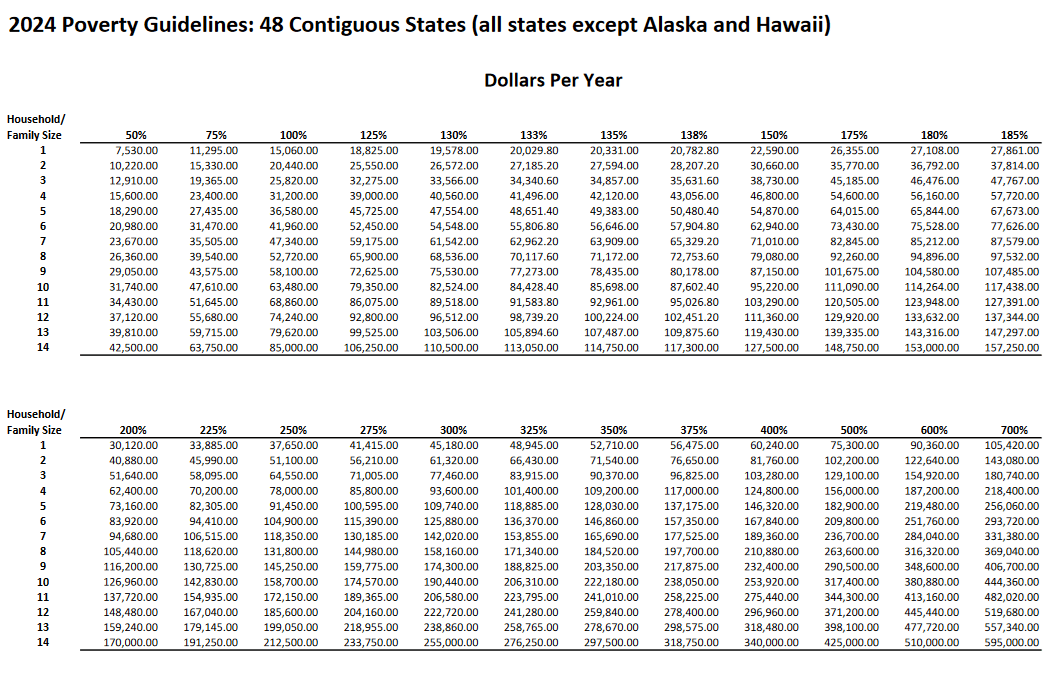

Your income, household, and filing status determines:

Where you fall on the Federal Poverty Level

How much Advance Premium Tax Credit you are eligible for with the Affordable Care Act

If you are eligible for Cost sharing reductions

The federal poverty level is the minimum required income to qualify for a health insurance subsidy. Your household size determines the dollar amount. The more dependents you have, the level moves higher.

If you are below 250% of the federal poverty level, you qualify for cost sharing reductions.

Advanced Premium Tax Credit

A tax credit you can take in advance to lower your monthly health insurance payment (or “premium”). When you apply for Health Insurance coverage in the Marketplace, you estimate your expected income for the year. If you qualify for a premium tax credit based on your estimate, you can use any amount of the credit in advance to lower your premium.

If at the end of the year you’ve taken more premium tax credit in advance than you’re due based on your final income, you’ll have to pay back the excess when you file your federal tax return.

If you’ve taken less than you qualify for, you’ll get the difference back.

Note: It's important to make sure you let your agent know if you have any life changes, like household, income, or employment changes. We update your policy, with no gaps in coverage, so you have little to no tax penalties at the end of the year.

This means you can qualify for:

Lower co-insurance (Insurance pays a higher percent of costs)

Lower deductibles

Lower co-pays for generic drugs & doctor visits

Lower monthly premiums

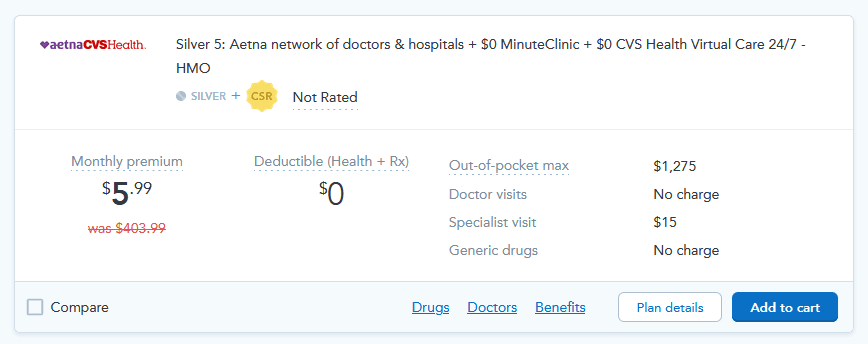

Example Policy:

(Policy is for $15,100 income for a single household)

What happens if I make too much? Can I still get a Silver plan?

Yes! Even if you don't qualify for a cost sharing reduction, silver plans are still available in the marketplace for all income sizes, however in some cases Gold plans may be better at a higher cost.

Below are the following typical co-insurance per plan level:

Bronze: Insurance pays 60%/You pay 40%

Silver: Insurance pays 70%/You pay 30%

Gold: Insurance pays 80%/You pay 20%

Platinum: Insurance pays 90%/You pay 10%

Conclusion

To maximize your savings:

Assess your income and household size: Ensure accurate estimates to qualify for the appropriate level of subsidies.

Utilize Advance Premium Tax Credits: Lower your monthly premiums and avoid unexpected costs by keeping your income information up-to-date.

Take advantage of Cost Sharing Reductions: If eligible, enjoy lower co-insurance, deductibles, and co-pays for essential health services.

Choose the right plan: Even if you don't qualify for subsidies, explore Silver and Gold plans to find the best coverage for your needs.

Remember, keeping your information current with your health insurance agent can help you avoid tax penalties and ensure continuous coverage. Stay proactive and informed to secure the best health insurance benefits and financial savings available to you.

© Nebula Insurance Agency LLC. 2024